Joby Weeks, an early Bitcoin advocate and promoter from Colorado, became involved with BitClub Network (BCN), a Bitcoin mining cooperative active from 2014 to 2019. Prosecutors labeled it a $722 million Ponzi scheme, charging him with fraud-related offenses.

Weeks, who neither owned nor managed BCN, pleaded guilty in 2020 to tax evasion and conspiracy to sell unregistered securities. However, his sentencing has faced ongoing delays—the latest rescheduled for June 2, 2025, following earlier dates in March and February 2025, with no resolution as of July 16, 2025. He maintains his innocence in the broader scheme, emphasizing BCN's legitimate mining that generated billions in value.

Watch the follow up discussion about Joby’s case here with Attorneys Brad Geyer and Warner Mendenhall.

Below are key problems with the case, explained clearly to highlight just a few of the potential injustices directed against Joby by the over .

Limited Role Overlooked

Weeks held no ownership, equity, or managerial authority in BCN; his involvement was strictly promotional, akin to endorsing a product. Despite this, he faced broad conspiracy charges treating him as equally culpable as founders. In contrast, similar high-profile crypto projects like Ripple (raising $1.3 billion) or Ethereum resulted in civil settlements or no charges for promoters, raising questions about inconsistent prosecutorial discretion.

Regulatory Ambiguity at the Time

During BCN's operations (2014-2017), federal guidelines on cryptocurrency mining pools were fragmented and unclear—no comprehensive rules classified such activities as securities requiring registration. Charging Weeks retroactively violates principles of fair notice and due process, as agencies like the SEC only clarified token-related securities in 2017's DAO Report, well after BCN began.

Evidence Withholding (Discovery Violations)

The government failed to disclose critical materials, including blockchain transaction records, IRS tax forms (e.g., 1099-B and 4684), and internal memos. This breached constitutional obligations under Brady v. Maryland and Giglio, preventing a fully informed defense and plea decision.

Pretrial Asset Freezes Undermining Defense

Assets, including Bitcoin and funds, were seized pretrial without proving they were tainted by crime, leaving Weeks unable to afford lawyers or experts. This financial pressure compromised his Sixth Amendment right to counsel and created coercive conditions for his guilty plea, a tactic criticized in similar cases for turning enforcement into punishment before conviction.

Prolonged Delays and Lack of Victims

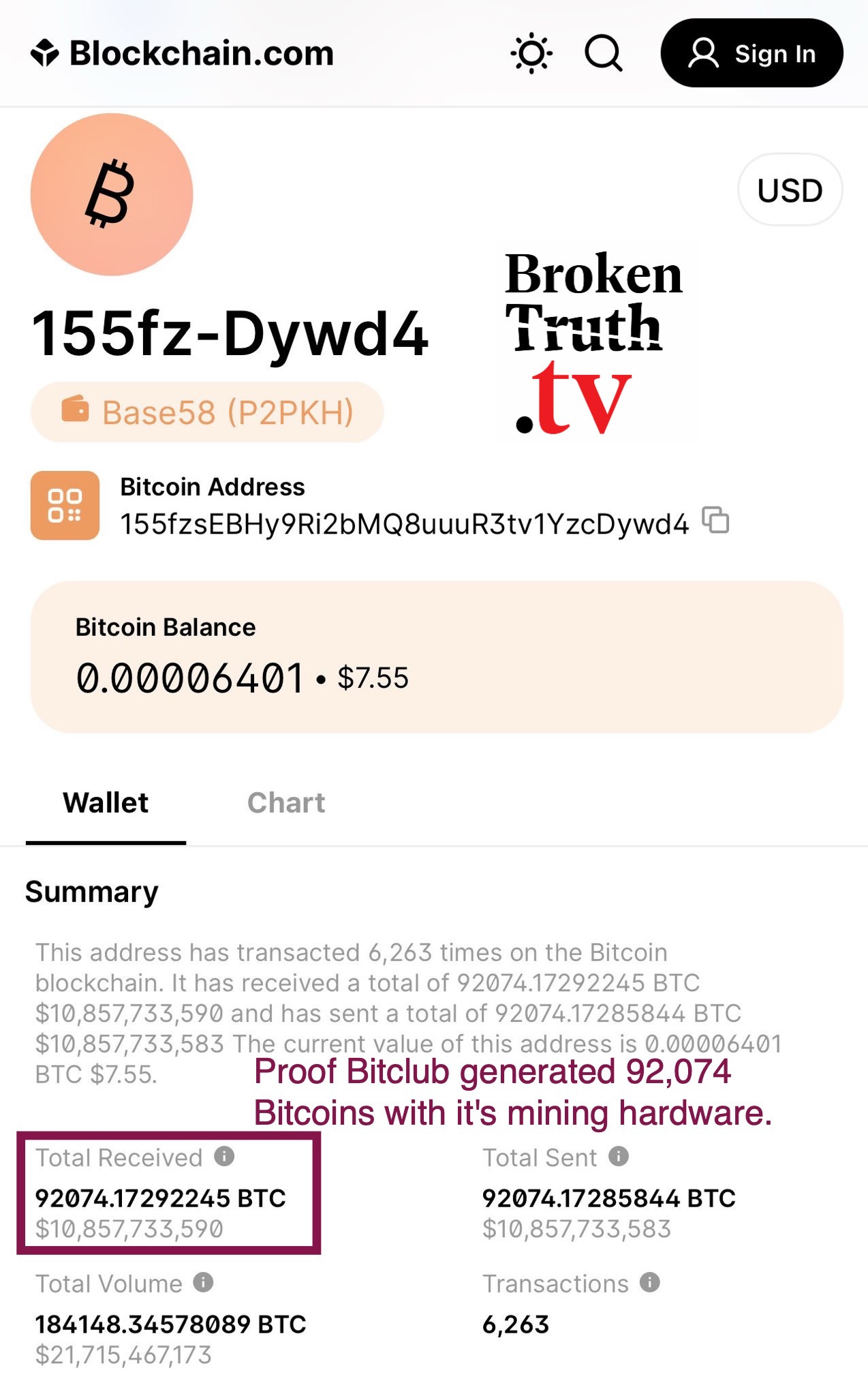

Weeks has endured nearly six years under house arrest with an ankle monitor, restrictions on travel, employment, and daily life (e.g., no phone/computer, mandatory drug tests unrelated to charges), and over 33 continuances without a trial. No verified victims have emerged seeking restitution; BCN mined 92,000 Bitcoin and 650,000 Ethereum (valued at $10 billion today), suggesting participants profited rather than lost.

Outdated Policies Now Rejected

The 2025 DOJ Blanche Memo explicitly shifts away from "regulation by prosecution," discouraging charges in unclear regulatory areas and focusing on intentional fraud. It disbanded the National Cryptocurrency Enforcement Team and aligns with Trump-era pardons (e.g., BitMEX founders). Weeks' case reflects the pre-2025 aggressive approach, warranting review under new guidelines for consistency and fairness.

Selective and Unequal Enforcement

While massive scams like OneCoin or BitConnect targeted central figures, BCN swept in peripheral players like Weeks. Global regulators (e.g., EU's MiCA framework) prioritize clarity and civil resolutions over criminalization for similar activities, making U.S. handling appear disproportionately harsh and anomalous. This pattern extends to other refusals by the DOJ and IRS to investigate high-profile entities; for instance, in May 2024, whistleblower William Scott filed IRS Form 211 in Miami, Florida, seeking to revoke the Bill & Melinda Gates Foundation's non-profit status over alleged for-profit vaccine investments and conflicts of interest (e.g., influencing COVID-19 hydroxychloroquine trials for potential bias). The IRS denied the claim without action, and a federal court dismissed Scott's lawsuit in January 2025, citing lack of jurisdiction—highlighting perceived selective scrutiny where powerful foundations evade investigation while individuals like Weeks face prolonged pursuit.

This situation underscores broader flaws in early crypto enforcement, where innovation faced punitive measures without solid legal footing. Weeks seeks vindication, asset return, and family focus, and his ongoing efforts—including a January 2025 counterclaim alleging overreach and a push for presidential pardon—aim to highlight these issues. Sharing his story or contacting policymakers could push for reforms, ensuring fairer treatment in emerging tech cases.

See attorneys Warner Mendenhall, Former Feds Brad Geyer and host John Davidson discuss this case LIVE on BrokenTruth.TV at 2pm et, 11am pt on Monday 7/21/2025.